Volatility calculator online

Days - is the number of days in the future for which the probability will be computed. It is a rate at which the price of a security increases or decreases for a given set of returns.

Volatility Calculation Historical Varsity By Zerodha

Before deciding to trade you should carefully consider your investment objectives level of experience and risk appetite.

. Trading with leverage can work against you as well as for you. How to calculate. To get the CAGR value for your investment enter the starting value or initial investment amount along with the expected ending value and the number of months or years for which you want to calulate the CAGR.

Ethereum Ƀ 005496000 Ƀ 34027k 185 Ƀ 000099000. Analysts believe that the ETFs are facing the brunt of volatility in gold prices. Trading FX and CFDs on margin carries a high level of risk and may not be suitable for all investorsCMS Prime offers trading on margin.

Higher liquidity usually creates a less volatile market in which prices dont fluctuate as. It can also be used to calculate the margin benefit of multi-leg FO strategies across different segments. Tangible assets such as real estate or jewelry may require the payment of capital gains tax if the assets are sold for profit.

Days are counted starting from the most recent trading day. For more information about inheritances or to do calculations involving estate tax please visit the Estate Tax Calculator. So you actually benefit from market volatility.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option trader to know how. A lumpsum calculator has a formula box to input the investment amount the investment duration in years and the estimated annual rate of return. Just enter your parameters and hit calculate.

Gold prices have fallen up to 10 in the last six months and around 20 from its historical peak in the pandemic. Its a clever way to figure out the return on a lump-sum mutual fund investment. Using the Black and Scholes option pricing model this calculator generates theoretical values and option greeks for European call and put options.

Follow the simple steps below and then click the Calculate button to see the results. Black Scholes model assumes that option price can be determined by plugging spot price exercise price time to expiry volatility of the underlying and risk free interest rate into. The Chicago Board Options Exchanges CBOE Volatility Index VIX closed flat at 2621 points on Tuesday.

The outcome of these calculators is determined by user input. Investment returns depend on an investors risk. Do bear in mind the calculation wont reveal the potential price fluctuations andor volatility of an investment.

Our online calculator may be used to calculate stock profit for Penny stocks a feature not offered by the majority of internet financial calculators. It shows the range to which the price of a security may increase or decrease. Why index funds are theoretically optimal.

The volatility of stock prices presents an opportunity to buy low at the net buy price and sell much higher at the desired sale price. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. Rupee-cost averaging helps reduce risk by allowing you to buy more units when markets are low and buy fewer units when markets are climbing.

Days can be calculated by selecting an Expiration Date. Benefiting from Risk - Stock markets carry the risk of volatility. Understand diversification and the Efficient Frontier find a portfolio with the maximum Sharpe Ratio.

CAGR Calculator is free online tool to calculate compound annual growth rate for your investment over a time period. Fintras Online XIRR Calculator uses XIRR Formula to measure the rate of return on investments - XIRR remains the best way for p2p investors to independently determine their accounts internal rate of return. You can define the period of days to calculate the average true range volatility.

An online 5paisa margin calculator is a tool that assists you in easily calculating the margin requirement on FO trades. Therefore the annualized volatility for the SP 500 in 2015 is 274 based on the daily volatility or daily price movements in August 2015. A markets liquidity has a big impact on how volatile the markets prices are.

Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. Volatility is the measure of how drastically a markets prices change. Intro to Modern Portfolio Theory.

Advantages of using this mutual fund SIP Calculator. Volatility measures the risk. By using a SIP calculator.

The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. Also the value of estates may change due to factors such as legal rights or financial volatility. Investors are now awaiting the release of non-farm payrolls data due this Friday.

A lumpsum calculator is a valuable tool that tells you how much money youve made over time. How to calculate the Standard Deviation When you have a series of data points. The gold funds category has offered an average return of -220 in one month and -076 in three months.

Price - is the current Stock Price. Tether Ƀ 000005186 Ƀ 471bn 5. NTM Volatility - Near The Money Volatility is the implied volatility interpolated from current near term near the money option.

Volatility volatility market cap market cap. Lower liquidity usually results in a more volatile market and cause prices to change drastically. Use the Pay Raise Calculator to determine your pay raise and see a comparison before and after the salary increase.

Toggle navigation Option Calculator. Plan your life with a Monte Carlo calculator.

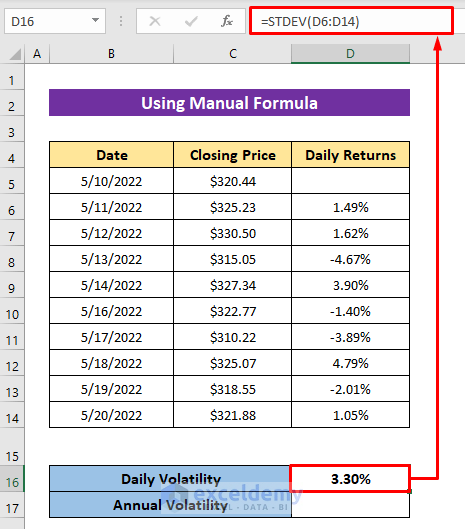

How To Calculate Volatility Using Excel

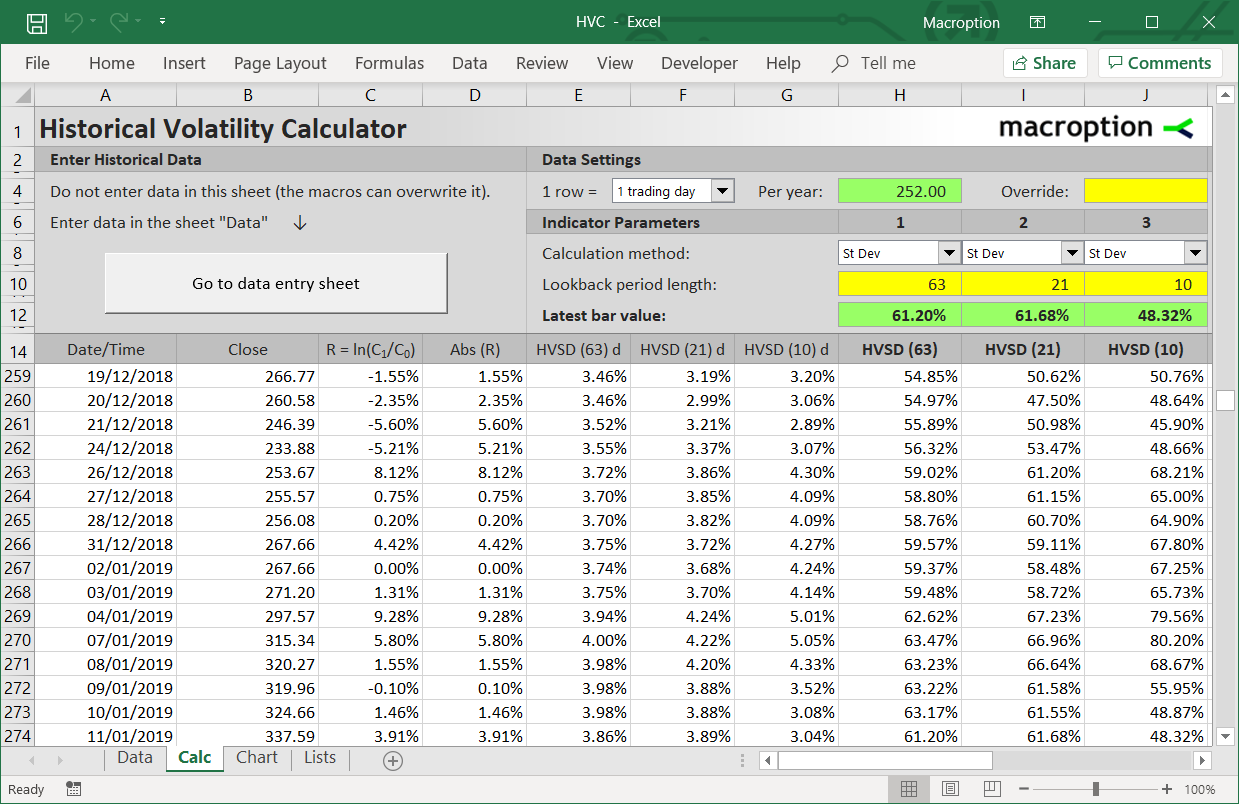

Historical Volatility Calculator Macroption

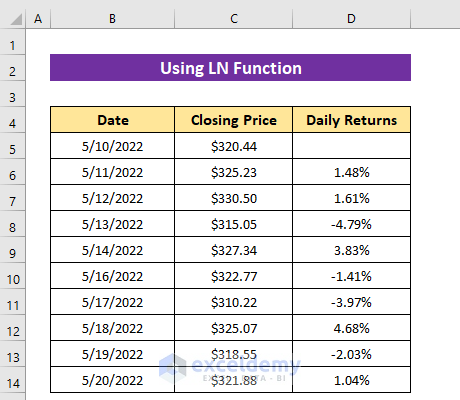

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

What Is Volatility And How To Calculate It Ally

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Calculate Implied Volatility With Vba

What Is Volatility Definition Causes Significance In The Market

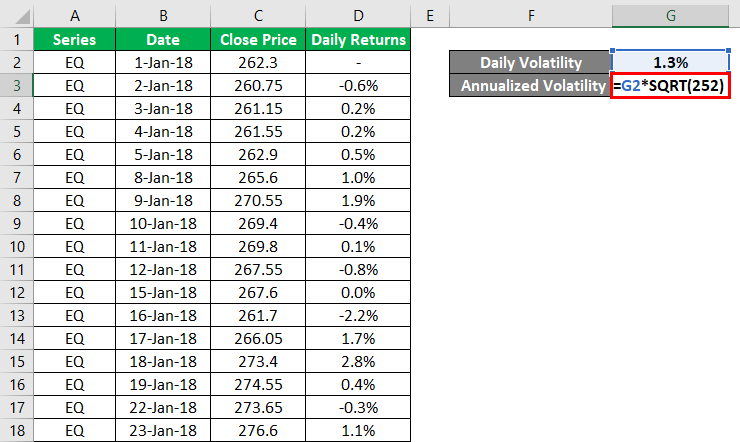

How To Calculate Volatility Using Excel

Volatility Formula Calculator Examples With Excel Template

Computing Historical Volatility In Excel

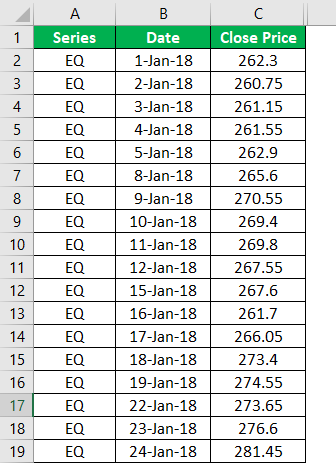

How To Calculate Share Price Volatility In Excel 2 Easy Methods

How To Calculate Share Price Volatility In Excel 2 Easy Methods

How To Calculate Volatility Using Excel

How To Calculate Share Price Volatility In Excel 2 Easy Methods

Volatility Calculation Historical Varsity By Zerodha

Implied Volatility Iv Formula And Calculator Detailed Steps For Calculating Iv