How much are repayments on a 5000 loan

LIBOR or ICE LIBOR previously BBA LIBOR is a benchmark rate which some of the worlds leading banks charge each other for short-term loans. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

Pin On Bullet Journal

New student Irma Scholar needs a 1000 student loan enough to buy her 20 trips to the supermarket.

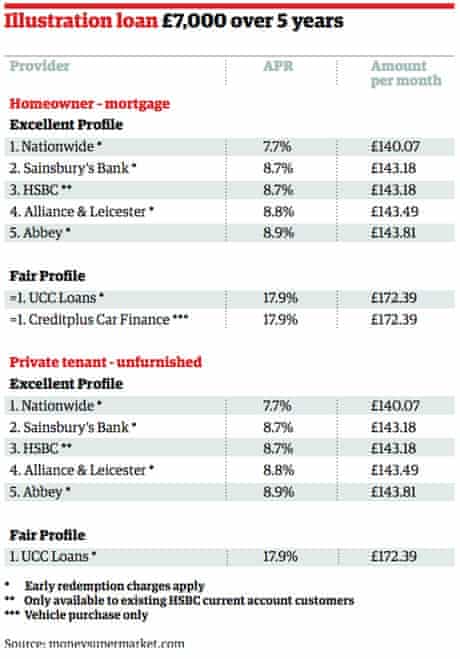

. Use our car loan calculator to estimate your repayments on a new or used car loan. At 60000 thats a 120000 to 150000 mortgage. Personal loan interest rates usually run from 6 to 36 while installment loans usually run from around 100 to 300 APR.

21 - 55 Years. The threshold for Plan 4 loans is 25375 which means if you earn 30375 a year youll repay 9 of 5000 the difference between your earnings and the threshold a sum total. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

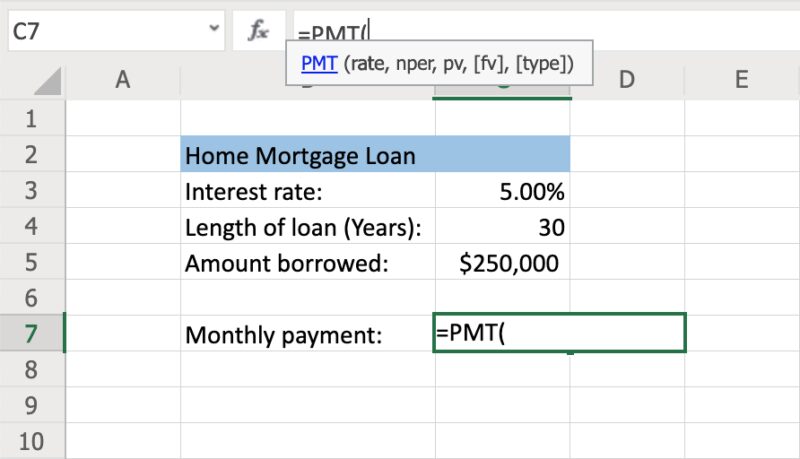

The FULL LOAN GRANT AWARD is 10793 so add up the loan and any grant received then subtract that from this. The score shows your promptness in repaying your loans and bills. In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM.

Its a loan thats secured against your property and for that reason is only available to people who own their home. The difference is the parental contribution. The total amount of your loan will depend on the specific circumstances of your business.

A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. Cashback deals are when a lender offers you cash generally between 1000 to 5000 or higher when your loan application is approved. Stashing the loan repayments in a top savings account could earn you more see Top Savings for the top picks.

A loans stated redemption price at maturity is the sum of all amounts principal and interest payable on it other than qualified. 23 to 68 years. 636a as added by section 1102.

Here are examples of how it works at different income levels. How much personal loan can I get on my salary. Some people can sleep soundly at night knowing that they owe 5000 per month for.

Because same day loans can now be repaid over a broad range of different periods you can now choose to repay such a loan in more affordable repayments. A straightforward home loan with a low variable rate unlimited extra repayments with redraw and no ongoing fees. The administration said that more than 60 of borrowers received Pell Grants.

Everything you need to know about Student Loan repayments including whether youre on Plan 1 2 or 4 how much youll repay and when the loan is cancelled. The first two options as their name indicates are fixed-rate loans. An ARM or adjustable rate mortgage.

3 4 or 5 year loan term available. The loan interest rate is set at the rate of inflation which over the next 10 years averages 4. Comparison Rate 416 pa.

Most loans will furthermore offer a fixed APR and will set the repayments in advance which means that you can be sure of how much you need to pay back each month and plan accordingly. Calculate your estimated home loan repayments and see how a rate. The loan amount depends on your.

Loans between 50 and 5000 over a 3-month to 36-month term. Our calculator features repayment frequency balloon payments loan term options and more. Both parties will need to make clear to the charity involved how much of any donation relates to each of them.

16 owe less than 5000 and a little less. Weve used our loan calculator to highlight some examples below. When you make an application for a specific amount we consider a variety of factors to determine the health of your business and the level of repayments your business can support.

How much is the loan forgiveness and what are the limits. It takes into account all your past credit card bill payments and loan repayments. The amount paid for the property does not exceed 5000 per invoice or per item substantiated by invoice.

How much is the loan forgiveness and what are the limits. Forgive loans after 10 years of repayments for borrowers who owe 12000 or less and. A 400000 loan amount variable fixed principal and interest PI home loans with an LVR loan-to-value ratio of at least 80.

Property Investment Loans. No monthly or ongoing fees. How Much Mortgage Can I Afford if My Income Is 60000.

A family with household income of Will get a grant of Plus a student loan of So the total award is. Forgive loans after 10 years of repayments for borrowers who owe 12000 or less and. It stands for Intercontinental Exchange London.

61 3 9495 5000. So if the total repayment figure of your loan is 5000 yet to keep repaying it each month costs 5100 in total you only gain 100 by paying it off now. Generally rates and terms vary depending on factors like your credit score and income.

Contact Us 61 3 9495 5000. Unsecured loans also tend to come with lower interest rates than credit cards and allow you to borrow more than on cards. Chapter 345 Claiming Gift Aid on waived refunds and loan repayments.

Use our calculator to see how much a 5000 loan might cost you each month. However if in doubt of the calculations always err on the side of. To help keep this example simple Irma decides to repay it all at once in 10 years time having never repaid a penny before.

Choose between a low fixed or variable rate. 5000 to 100000 loan amount. Thats why at Loan Gallery we customise your loan to suit your unique needs.

With a secured loan you can borrow between 10000 and 250000 for a duration of up to 25 years. Late repayment can cause you serious money problems. A loan is the act of giving money property or other material goods to another party in exchange for future repayment of the principal amount along with interest or other finance charges.

This means your interest rate and monthly payments stay the same over the course of the entire loan. We provide loan amounts between 5000 and 150000. Of those with debt 16 owe less than 5000 and a little less than 3 owe more than 200000.

Therefore you can now borrow more substantial amounts. A secured loan sometimes called a homeowner loan is just that. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a.

Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you in interest payments thats just on the extra borrowing Yet borrowing 5000 at an interest rate of 3 over three years perhaps through a personal loan would cost you 23141 in interest.

Combat The Obstacles Come In Your Way To Pursue Uninterrupted Studies Quick Loans Education Related Short Term Loans

Payday Installment Loan Singapore Money Lender Installment Loans Loan Consolidation

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Loan Payment Calculator Finaid

Personal Loan Calculator Student Loan Hero

Loan Calculator Credit Karma

Personal Loan Calculator Student Loan Hero

Personal Loan Calculator 2022 Calculate Your Monthly Payment Smartasset Com

If You Want A Personal Loan You Ll Need To Be Perfect Personal Loans The Guardian

Average Student Loan Payment Estimate How Much You Ll Pay

Excel Formula Calculate Payment For A Loan Exceljet

Personal Loan Calculator 2022 Calculate Your Monthly Payment Smartasset Com

How To Calculate Loan Payments And Costs Nextadvisor With Time

Most People Are Aware Of The Fact That Late Payments Can Have A Negative Impact On Credit Scores For This Reason Budget Saving Money Saving Tips Debt Relief

How To Calculate Monthly Loan Payments In Excel Investinganswers

Does Timely Repayment Of Your Student Loans Make Sense Student Loans Student Loan Repayment Student Loan Debt

Bootstrapping Or Business Loan For Your Startup Business Business Loans Private Equity Student Loans